Summary Findings

- While it’s unknown how the unfolding COVID-19 outbreak will impact the economy in the

long-term, BC is facing a sudden stop in economic activity with little guidance to when things

may return to normal. - Based on our scenario analysis, BC home sales and prices will likely face declines in the

spring and early summer but should recover along with the wider economy in the second

half of the year, contingent on the outbreak resolving. - The postponed change to the mortgage stress test rate, originally slated for April 6, 2020,

will mute the impact of falling interest rates for the BC housing market.

How will the COVID-19 outbreak impact the BC economy and, more specifically, the BC Housing market?

The correct answer is a rather unsatisfying “nobody knows.” We have already seen a steep decline in interest rates, however, it’s unknown how severe the impact will be on economic activity. Global supply chains will be impacted, as well as tourism and travel. The magnitude of impact is expected to vary by province but may be significant for the BC economy given the importance of tourism to our economy and our strong trade linkages with China. The additional shock to the Canadian economy due to a collapse in oil prices – itself the by-product of a price war between the world’s largest oil producers due to COVID-19 – makes the probability of a recession in Canada that much higher.

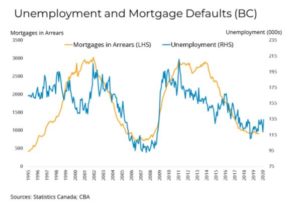

An unfortunate but unavoidable product of recessions is losses in employment and incomes, which may put some financially vulnerable families in an even more precarious position. The CMHC announced that it would be working with lenders to defer mortgage payments by up to six months if needed, which should stem potential mortgage defaults and foreclosures. However, there is still a need to address lost income for those who cannot afford to practice social distancing by staying home from work and for those who have to make monthly rent payments and can’t take advantage of payment deferrals. For those individuals and families, cash is king. That means these households will need government cash transfers to meet their financial priorities during this time, and we hope this will be part of the yet-to-be-announced stimulus package from the Canadian government.

On the positive side, governments and central banks seem to be taking lessons from the last crisis and have implemented measures to ensure small businesses and the financial system have ample liquidity and access to credit. The Bank of Canada has reduced its overnight rate to 0.75 percent and we expect they will follow the US Federal Reserve down to near zero in short order. This should help prevent a 2008 scenario of spiking borrowing costs due to rising risk premiums and credit rationing.

These measures should help to dampen the impact of the COVID-19 outbreak on the economy. However, faced with an almost unprecedented paralysis of economic and social activity, monetary and fiscal policy can only safeguard against a worst-case scenario and hope the outbreak resolves in the coming months so we can all get back to normal.

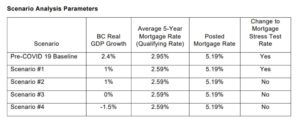

Of note, the Canadian government has postponed changes to the mortgage stress test. The qualifying rate for insured mortgages was set to change from the 5-year posted mortgage rate to the average 5-year fixed rate plus 200 basis points on April 6, with the B-20 stress test for uninsured mortgages to follow suit. By postponing that change, the government has muted the passthrough from monetary policy to the housing market, particularly since the 5-year posted rate has maintained at 5.19 percent, despite the average 5-year contract rate falling to near historical lows. The impact of dramatically lower rates will still help those renewing or refinancing mortgages at lower rates by freeing up monthly cash-flow due to lower mortgage payments.

Scenario Analysis: COVID-19, the BC Economy and the BC Housing Market

The Canadian economy has endured three recessions since 1980. During those times, the BC economy has experienced an annual contraction of GDP or growth falling to near zero. In each of those periods, BC homes sales have experienced sharp declines that have lasted between 12 and 14 months. We will not begin to see the impact of COVID-19 in economic data until later in the spring due to lags in processing data, but we know based on our own tracking that the BC economy was growing slowly even before the outbreak, with estimated real GDP growth under 2 percent for the last several months.

The COVID-19 outbreak is occurring at a time in which BC housing markets are recovering from a two-year slowdown in activity. Home sales are currently trending at a healthy pace, close to their long-term average, and growth in home prices has been strong due to a lack of inventory.

With those initial conditions and historical precedents in mind, we have sketched out how the rapidly changing financial and economic environment may impact the BC housing market.

Given the level of uncertainty, we limit our analysis of the impacts of COVID-19 to 2020, to concentrate on immediate short-run impacts and abstract from any potential supply-side impacts such as changes to residential construction that may occur over a longer time frame. To model the possible impacts for home sales and prices, we concentrate on how COVID-19 impacts factors that shift short-term housing demand. In particular, we are interested in whether lower interest rates will dominate the impact of slower, or even negative, economic growth.

Real estate is a face-to-face business, so practices that are necessary to prevent the spread of the virus are at odds with buying and selling homes. This may produce stronger impacts than we can model using standard frameworks. As guidance, and reflecting on the immense uncertainty surrounding the economic outlook, we based our simulations on several scenarios:

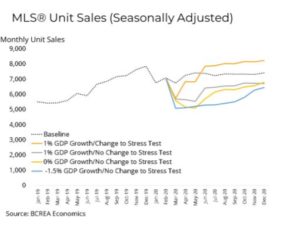

Results Unsurprisingly, the results of our simulations show a steep decline in home sales in the second quarter of this year as economic activity becomes eerily quiet. From there, home sales slowly recover, though remain below baseline for 2020. In the event of a deeper and more prolonged recession, home sales remain depressed for the remainder of the year, falling about 20 percent below baseline. In contrast, in Scenario #1, where the fall in interest rates is passed through to the qualifying rate, home sales rise above baseline after an initial steep drop.

As for home prices, the growth slowdown and associated decline in transactions will likely cause a temporary but modest swoon in home prices, which are then expected to recover to baseline over the next year as growth recovers. Again, the pass-through of falling interest rates to the qualifying rate makes a large difference in outcomes. Our simulations show that a much lower qualifying rate would lead to home prices in some BC markets ending the year higher than our pre-COVID-19 baseline. This result is likely why the Federal Government has opted to postpone the change. However, given the uncertainty surrounding the outlook, this may ultimately be a mistake. If the growth outlook deteriorates, the housing market may need a lower qualifying rate to fully recover.

The results of these simulations are far from definitive, but they provide a framework for thinking through the potential magnitude of the impacts of the COVID-19 outbreak. Most important to remember is that this period, no matter how unusual and anxious it is now, will pass and the economy and housing market will return to health.

Copyright BCREA – reprinted with permission